-

READ MORE:

The average U.S. credit score DROPS for the first time in ten years

Credit scores are a crucial aspect of overall financial well-being.

However, these scores — which determine our eligibility for crucial financial services like mortgages, auto loans, and credit cards — are also fraught with inaccuracies.

Credit scores range from 300 to 850. Scores below 629 are regarded as ‘poor’.

Anything over 720 is considered ‘excellent’.

as stated by the credit scoring firm FICO.

A low score might lead to

increased interest rates on loans

And even being considered unsuitable for financial products like mortgages.

Here is finance expert Monique White, who leads the community

at Self Financial

– This service assists Americans in enhancing their credit scores – debunks the top fivecredit score misconceptions and provides guidance on avoiding these pitfalls.

1. Reviewing your personal credit report can negatively impact your score.

Understanding your financial position is crucial for achieving monetary success, and reviewing your credit report serves as a means to gain comprehensive insight into your economic standing.

A lot of individuals think that reviewing your personal credit report can lower your credit score.

Although you should be wary of credit checks that result in hard inquiries, checking your own report is considered a soft inquiry and does not affect your score.

You can obtain your credit report without charge at

annualcreditreport.com.

2. Keeping a balance on your credit card can boost your score.

Many people think that keeping a low balance on your credit card can aid in building up your score.

Nevertheless, maintaining an outstanding balance on your credit card over multiple months can lead to accruing interest charges.

A rule of thumb for revolving debt is to keep your balances below 30 percent of your available credit.

However, it’s advisable to settle your entire balance each month to evade fees and maintain a low credit utilization ratio.

3. You possess just a single credit score.

The three primary credit-reporting agencies are Experian, Equifax, and TransUnion.

Each bureau may have different data on your credit activity (like tradelines and collections) which is why each one may report a different score.

While FICO and VantageScore are the most commonly used credit scoring models, multiple versions and industry-specific credit scores can result in different scores, depending on the lender and the type of credit you’re applying for.

4. Your income impacts your credit score

Even though your earnings can affect your eligibility for specific loan products, they do not play a role in determining your credit score.

Your score comprises five elements: your payment history, how much credit you’re using, the duration of your credit history, newly acquired credit, and the variety of credits available to you.

5. Upon getting married, you will jointly own a credit score with your partner.

Getting married doesn’t merge your credit scores automatically.

Everyone will still maintain an individual score derived from their personal financial background.

If a couple decides to jointly apply for credit cards, co-signs a loan, or one becomes an authorized user on the other’s account, these actions will affect both of their credit reports.

Therefore, it’s crucial to bear this in mind whenever you’re making joint financial choices.

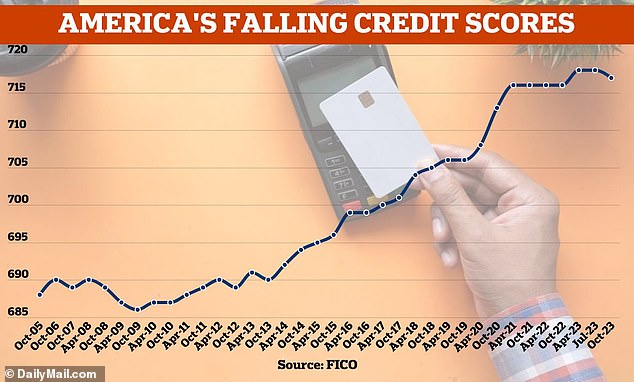

The critical warning emerges as Americans’

Credit scores drop for the first time in ten years.

Thanks to all-time high prices and increased interest rates driving more Americans deeper into debt.

According to FICO, the nationwide average credit score dropped to 717 from its peak of 718 at the start of the previous year.

In the past decade, each time an average score was recorded, it showed either growth or stability—climbing from 690 in October 2013 to 718 last April.

Nevertheless, an additional specialist previously stated last year

busted another big myth

, all you need is a solid score, not a flawless one.

Once your score reaches 740, you’re regarded as having an outstanding credit rating for credit cards, car loans, and various non-mortgage financial products, says Ted Rossman, senior industry analyst.

Bankrate

.

“For mortgage purposes, I’d set the cutoff at 780,” he stated.

.

After that stage, I would surely keep up with the positive practices that contribute to a solid credit score, yet I wouldn’t stress over achieving flawlessness.

He stated that achieving a higher score doesn’t offer any real advantages; instead, it merely gives you something to boast about.

Read more